Tech Stock Earnings Crisis? Why Smart Investors Are Pivoting to Physical Assets

With technology stocks experiencing their most challenging earnings period since late 2023, institutional investors increasingly recognize the fundamental vulnerability of sectors dependent on quarterly performance metrics, regulatory changes, and cyclical corporate earnings. This earnings-driven volatility demonstrates why sophisticated portfolios require allocation toward tangible assets that maintain value independent of corporate financial statements and earnings call disappointments.

This Article Covers:

- The immediate impact of Q2 tech earnings disappointments on market stability

- Why corporate earnings volatility drives investors toward physical assets

- How semiconductor and automotive sector disruption affects traditional portfolios

- Why investment-grade collector cars offer stability during tech sector uncertainty

- How MCQ Markets provides access to earnings-proof alternative investments

Tech Earnings Disaster: Q2 Results Expose Sector Vulnerability

Tesla’s earnings disappointment reinforced concerns about the electric vehicle sector’s dependence on government incentives. The company’s CFO warned of “adverse impacts” from recent legislation targeting EV and solar tax credits, with tariff costs increasing to approximately $300 million during the quarter. This regulatory vulnerability affected Tesla’s stock price immediately during the earnings call, demonstrating how policy changes can instantly impact technology valuations.

Beyond individual company struggles, the broader technology sector faced systemic challenges. ServiceNow provided one of the few bright spots with significant earnings beats, while companies like Alphabet raised capital expenditure forecasts to $85 billion, creating investor concerns about return on investment for AI-related spending.

Corporate Earnings Volatility: The Fundamental Risk Factor

Market analysts observed that technology companies entered Q2 with lowered expectations due to tariff concerns, elevated valuations, and economic uncertainty. However, even with reduced forecasts, many companies failed to meet adjusted targets, creating broader sector-wide selling pressure that affected unrelated technology investments.

The earnings dependency creates several specific risks for technology investors. Companies must continuously meet or exceed quarterly expectations regardless of market conditions, regulatory changes, or competitive pressures. This quarterly pressure forces management decisions that may prioritize short-term earnings over long-term value creation, as demonstrated by Intel’s dramatic workforce reductions and business unit eliminations.

Alternative Investment Strategy: Physical Assets During Corporate Uncertainty

- Corporate Independence: Values determined by scarcity, craftsmanship, and historical significance rather than quarterly earnings reports or corporate restructuring announcements

- Performance Stability: Asset values uncorrelated with companies experiencing workforce reductions, business unit closures, or earnings disappointments

- Market Resilience: Physical assets that maintain value regardless of corporate earnings cycles or management strategy changes

- Inflation Hedge: Tangible assets historically preserve purchasing power during periods of corporate earnings instability and market uncertainty

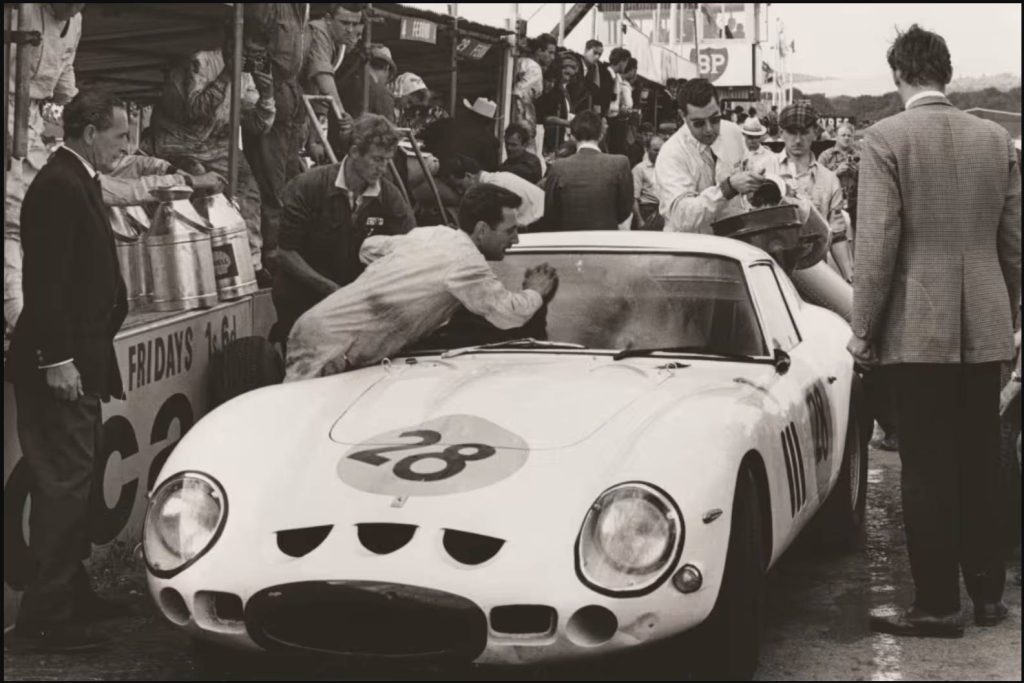

The collector car market’s independence from technology sector earnings makes it particularly attractive during current corporate uncertainty. While Intel, Tesla, and other tech companies manage workforce reductions and earnings misses, investment-grade collector cars continue appreciating based on fundamental factors completely divorced from quarterly financial statements.

- Long-view Performance: Collector car values unaffected by technology sector earnings or any short-term corporate performance metrics

- Professional Curation: Expert vehicle selection and management independent of corporate earnings cycles or quarterly performance pressure

- Fractional Access: Starting at $20 per share, providing institutional-quality exposure without requiring full vehicle acquisition<

- Performance Consistency: Historical appreciation based on automotive significance rather than corporate financial health

Investment Outlook: Navigating Corporate Uncertainty Through Physical Assets

The Q2 technology earnings disasters create a unique opportunity for sophisticated investors to recognize the limitations of earnings-dependent investments. While corporate America faces quarterly performance pressure and restructuring announcements, physical assets like investment-grade collector cars offer stability and growth potential completely independent of earnings reports.

This corporate earnings volatility reinforces fundamental portfolio construction principles: sectors dependent on quarterly performance metrics face inherent risks that can be mitigated through strategic allocation toward tangible assets. The technology sector’s current challenges demonstrate why resilient portfolios require assets that maintain value regardless of corporate earnings cycles.

Strategic investors recognize several key factors. The technology sector’s earnings disappointments affect entire industry segments, creating broad-based uncertainty that extends beyond individual companies to suppliers, contractors, and related service providers. This systemic impact highlights the importance of portfolio diversification through assets that exist completely outside corporate earnings dependency.

MCQ Markets addresses this need by providing institutional-quality access to collector car investments that appreciate based on automotive heritage, rarity, and craftsmanship rather than quarterly financial statements. Our fractional ownership platform allows sophisticated investors to participate in this stable asset class while maintaining portfolio liquidity and transparent ownership records.

The Q2 earnings season creates urgency for corporate restructuring and cost-cutting measures, but it also creates opportunity for investors seeking assets that remain unaffected by quarterly performance volatility. As technology companies navigate earnings disappointments and workforce reductions, collector car investments continue operating in a market driven by fundamental supply and demand factors rather than corporate financial health.

MCQ Markets provides the infrastructure and expertise to access this asset class through our proven fractional ownership model, combining cutting-edge technology with the time-tested stability of physical asset investing.